Where Is Pickleball Most Popular: US Hotspots, Asia’s Explosive Rise & Global Trends

Pickleball’s meteoric rise is one of the most fascinating stories in modern sports. Originating in 1965 on Bainbridge Island, Washington, as a hybrid of tennis, badminton, and ping-pong, it remained relatively niche for decades. The 2020s brought a perfect storm of pandemic-fueled outdoor activity, social media virality, and celebrity endorsements from the likes of LeBron James and Tom Brady. By 2026, pickleball’s trajectory shows no signs of slowing.

So, where is pickleball most popular today? The answer spans continents: the US dominates, but Asia’s explosive growth is reshaping the global landscape. This comprehensive analysis examines regional surges, infrastructure expansion, participation trends, and the nuanced data driving this sport’s popularity.

1. Global Snapshot of Pickleball Popularity

Quantifying global popularity reveals staggering growth:

- Ever-played worldwide: 80–120 million

- Active players: ~22 million

- Pre-2020 participation: <5 million

North America remains the epicenter with ~70% of active players, driven by easy access to courts and organized leagues. Europe follows, led by Spain and the UK, where pickleball often shares venues with tennis and badminton.

Asia is the wildcard: surveys indicate 812 million people have tried the sport, though sustained play is much lower (~282 million monthly participants). Population density, urbanization, and cultural familiarity with racket sports are key factors driving adoption.

Growth comparison:

- Tennis: 80 million global players; low annual growth

- Pickleball: +60% YoY in Asia alone

Media amplification: Google Trends (2025–2026) shows searches for “pickleball near me” surged 40% globally, signaling grassroots demand. Africa and South America lag, highlighting infrastructure as a limiting factor.

2. Pickleball Popularity by Country

When looking country by country, a clearer picture emerges. Rankings combine player estimates, growth rates, and infrastructure, sourced from SFIA, UPA, and DUPR.

| Country | Estimated Players (Active) | Growth Rate (YoY) | Popularity Rank |

|---|---|---|---|

| United States | 22.7M | 15–20% | 1 |

| India | 178M (extrapolated) | 159% | 2 |

| China | 60M | 60% | 3 |

| Canada | 1.54M | 35% | 4 |

| Vietnam | 16M (frequent) | 152% | 5 |

| Australia | 120K | 14% | 6 |

| Spain | 25K+ | 10% | 7 |

| United Kingdom | 200K (projected 2026) | 100% | 8 |

| Philippines | 50K | 4295% surge | 9 |

| France | ~50K | 20% | 10 |

Key Insights:

- US: Growth fueled by court conversions, organized leagues, and events.

- India & Vietnam: Numbers inflated via surveys but reflect rising urban engagement.

- China: Government-backed fitness programs project 100M players by 2030.

- Europe & Oceania: Gradual growth; clubs and federations drive participation.

Projections indicate Asia may collectively surpass North America in total players by 2026.

3. Where Is Pickleball Most Popular in the US

In the US, popularity is shaped by climate, demographics, and infrastructure:

- 2024 US active players: 19.8M

- Projected 2026: 25M (+26%)

- Southern & Western states lead, historically attracting retirees.

- Average player age is dropping to 35, reflecting youth adoption.

Regional trends:

- South Atlantic region (Florida, Carolinas): highest density

- Urban hubs: New York, Houston, Austin

- Court count (nationwide): 68,458

Growth is amplified by media coverage (~100+ ESPN hours in 2025) and $900M investment in new courts.

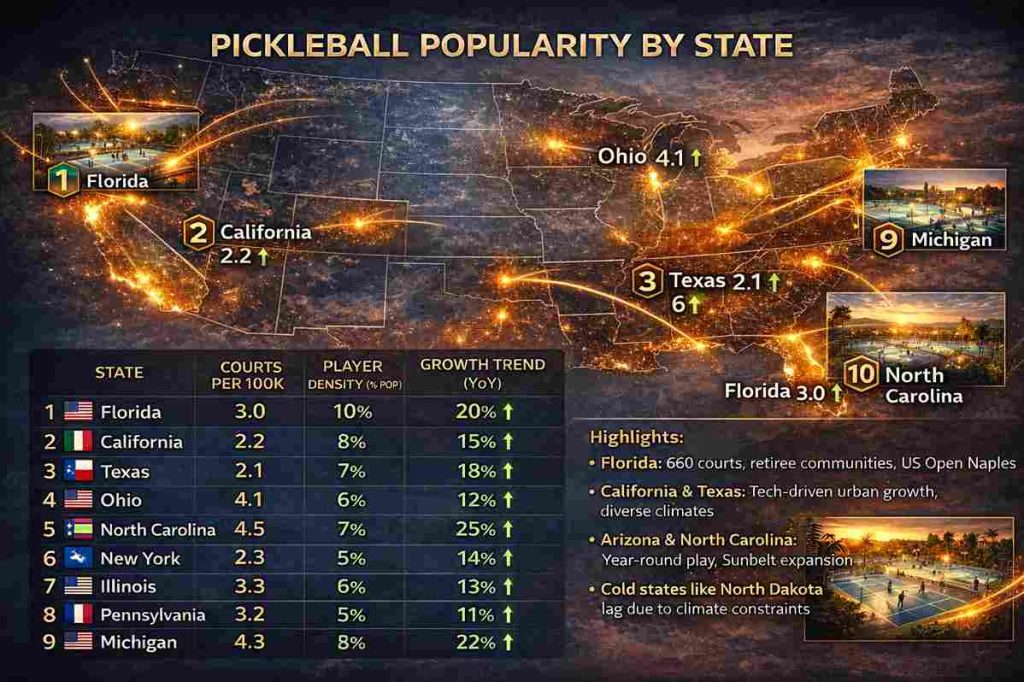

4. Pickleball Popularity by State

| State | Courts per 100k | Player Density (% pop) | Growth Trend (YoY) |

|---|---|---|---|

| Florida | 3.0 | 10% | 20% |

| California | 2.2 | 8% | 15% |

| Texas | 2.1 | 7% | 18% |

| Ohio | 4.1 | 6% | 12% |

| North Carolina | 4.5 | 7% | 25% |

| New York | 2.3 | 5% | 14% |

| Illinois | 3.3 | 6% | 13% |

| Pennsylvania | 3.2 | 5% | 11% |

| Michigan | 4.2 | 7% | 16% |

| Arizona | 4.3 | 8% | 22% |

Highlights:

- Florida: 660 courts, retiree communities, US Open Naples

- California & Texas: Tech-driven urban growth, diverse climates

- Arizona & North Carolina: Year-round play, Sunbelt expansion

- Cold states like North Dakota lag due to climate constraints

5. City-Level Pickleball Hotspots

| City | Overall Score | Notes |

|---|---|---|

| New York | 71.46 | Public parks + private clubs |

| Houston | 57.47 | Southern hospitality, 70 facilities |

| Miami | 54.20 | Celebrity tournaments, tropical climate |

| Atlanta | 52.30 | Community leagues, growth in suburbs |

| Las Vegas | 51.50 | Tourism + urban expansion |

| Naples | 65.00 | National Center, “Pickleball Capital” |

Projections: 25,000 new US courts by 2026, prioritizing Austin, Charlotte, and similar Sunbelt cities.

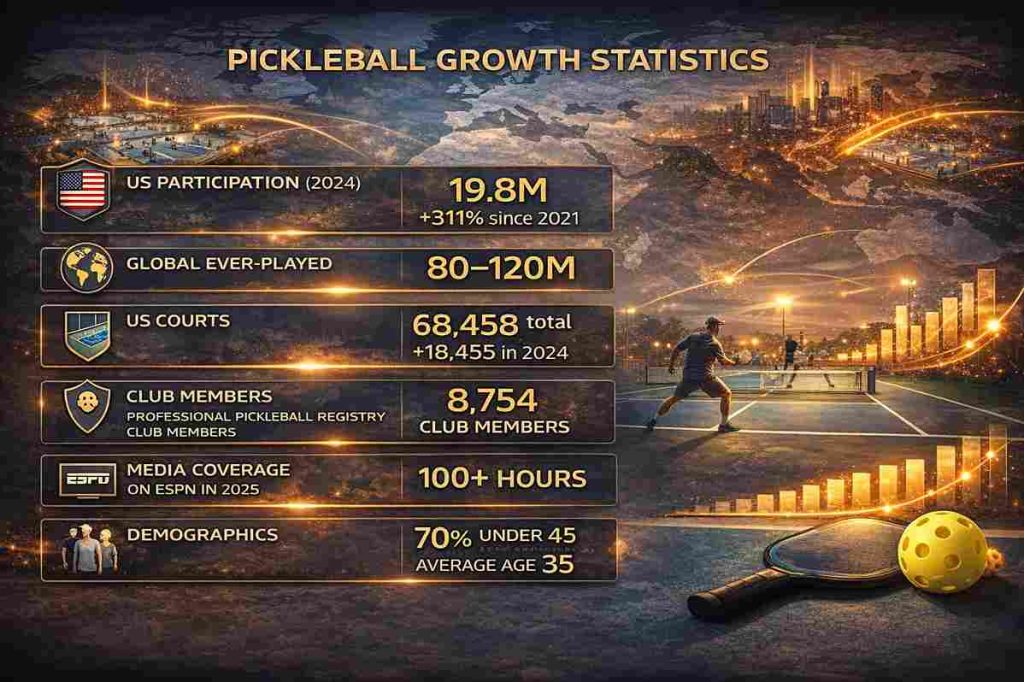

6. Pickleball Growth Statistics

- US participation (2024): 19.8M, +311% since 2021

- Global ever-played: 80–120M

- US courts: 68,458 total; +18,455 in 2024

- Club members: 8,754 in Professional Pickleball Registry

- Media coverage: 100+ hours on ESPN in 2025

- Demographics: 70% under 45, average age 35

Demographics of Pickleball: Who’s Playing Today

Pickleball continues to attract a wide and diverse range of players, which is a major factor in its rapid growth. While the sport appeals to all ages, certain trends are clear. The 25–34 age group leads participation at 16.7%, closely followed by those over 65 (15.4%) and 18–24 year-olds (13.3%), showing that both younger adults and seniors are embracing the game.

In terms of gender, approximately 59% of players are men and 41% are women, highlighting strong engagement across demographics. The average age of players is 34.8 years, indicating a steady influx of younger participants into a sport once dominated by older adults.

This broad demographic mix contributes to pickleball’s appeal, as it remains accessible and enjoyable for children, adults, and seniors alike, fostering multi-generational play and strong community involvement.

7. Pickleball Popularity Graph / Trend Visualization (Text-Based)

- X-axis: 2015–2026

- Y-axis: Players (millions)

- US line: Flat ~3M (2015), spike post-2020 to 19.8M (2024), projected 25M (2026)

- Global line: Sharper growth from 2023, 80M ever-played by 2026

- Asia: 60% YoY growth, surpassing Europe

8. Is Pickleball Popular in Asia?

Pickleball has seen an impressive surge in Asia, though adoption varies widely across countries. Reports indicate that 812 million people have tried the sport, with around 282 million participating monthly. Early adopters like Vietnam, where awareness reaches 88%, and India, which has seen 159% growth, have embraced the game, driven by their strong culture of racket sports and increasing urbanization.

Despite this growth, barriers remain, including limited court availability, urban space constraints, and cultural preferences for sports like badminton. Compared to padel—which is popular in Europe—pickleball’s simplicity, low cost, and accessibility make it especially attractive in densely populated areas.

Initiatives like the PPA Tour Asia are expected to further accelerate growth in 2026, cementing the continent’s role in the sport’s global expansion.

9. Pickleball vs Padel Popularity

While pickleball and padel are both rapidly growing racket sports, they differ significantly in participation, geography, and market momentum. Pickleball currently has 22 million active players worldwide, with strong dominance in the US and increasing penetration in Asia. In contrast, padel has around 30 million amateur players, concentrated in Europe and Latin America.

Pickleball’s rapid growth stems from its accessibility, ease of learning, and lower infrastructure costs, while padel relies on doubles play and enclosed courts, which suit European urban settings. Investment trends reflect this: the US has allocated $900 million to pickleball courts, while padel anticipates 85,000 courts globally by 2026.

Momentum also differs: US pickleball has grown 311% over three years, while padel has focused on incremental court expansion. Pickleball’s market potential is projected at $4.4 billion by 2033, underscoring why it is capturing investor and player attention worldwide.

10. Why Pickleball Is Growing Faster Than Most Sports

Pickleball’s explosive growth can be attributed to several factors. Accessibility tops the list: the sport is quick to learn, low-impact, and requires minimal equipment, making it appealing to players of all ages. Social connections and community play encourage regular participation, while health and fitness benefits broaden its appeal across demographics.

The timing of the pandemic accelerated adoption, as people sought safe outdoor activities, and widespread media coverage has sustained visibility, with ESPN airing over 100 hours of content in 2025. Comparatively, traditional sports like golf are declining, and tennis growth remains steady but slower.

Pickleball’s combination of rapid adoption, youth engagement, and media-driven awareness has fueled a 223% growth rate in the US since 2020, demonstrating why it is outpacing most sports in both participation and cultural relevance.

11. Future Outlook: Where Pickleball Will Be Most Popular Next

Looking ahead, pickleball’s global expansion shows no signs of slowing. By 2027, Asia could surpass the US in total players, with China projected to reach 100 million participants. Europe is expected to continue steady growth, particularly in the UK and Spain, supported by emerging federations and competitive leagues.

In the US, the development of indoor facilities will enable year-round play, while overall court expansions and infrastructure investments will meet rising demand. The global market for pickleball is forecasted to reach $8 billion by 2027, and emerging hotspots like Vietnam and India are poised to shape the next wave of growth.

As the sport continues to attract younger players and diversify geographically, it is well-positioned for Olympic consideration and further integration into mainstream sports culture, making pickleball a long-term player in the global recreational landscape.

Conclusion

Pickleball’s global footprint in 2026 demonstrates a sport that has truly transcended borders. With 80–120M lifetime players and 22M active, the US still dominates, particularly Florida, New York, and Texas, supported by 68,000+ courts and 311% growth in three years.

Yet, Asia’s rise is undeniable. Countries like India and China leverage mass populations, urban club networks, and government-backed initiatives, with regional surges like Vietnam’s 152% awareness spike. While data contradictions exist (UPA Asia vs SFIA), the overall trajectory is clear: pickleball is growing faster than most sports, both in participation and media visibility.

Infrastructure investments (~$900M) and demographic shifts toward younger players ensure the sport’s longevity. By 2030, US players may reach 40M, while Asia may collectively rival North America. Investors, coaches, and players should monitor emerging hotspots for opportunities, while US hubs refine access to meet demand.

Pickleball isn’t a fleeting trend—it’s a data-driven revolution reshaping recreation, urban planning, and professional sports culture worldwide.

Frequently Asked Questions

Jordan Blake

Jordan Blake is a racket-sports author with hands-on experience and a strong command of both tennis and pickleball. With a foundation built through years on the tennis court and a successful transition into competitive pickleball, Jordan brings practical insight, strategic clarity, and real-world understanding to every article.

Drawing on personal play, match analysis, and court-level observation, Jordan specializes in breaking down technique, tactics, and the mental aspects of both sports in a clear, data-informed, and accessible way. His dual-sport perspective helps readers understand how skills transfer between games—and where each sport demands its own distinct mastery.